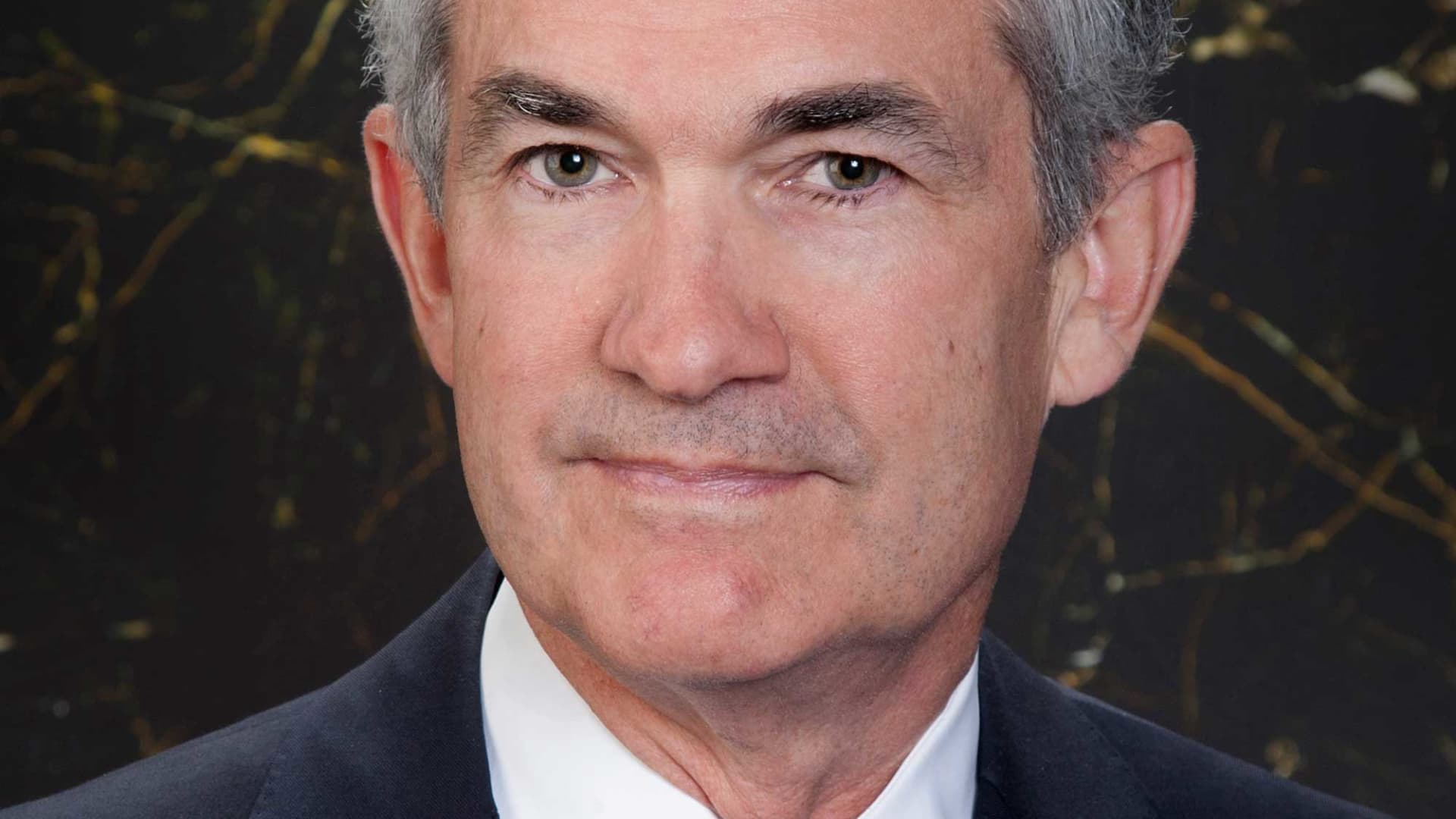

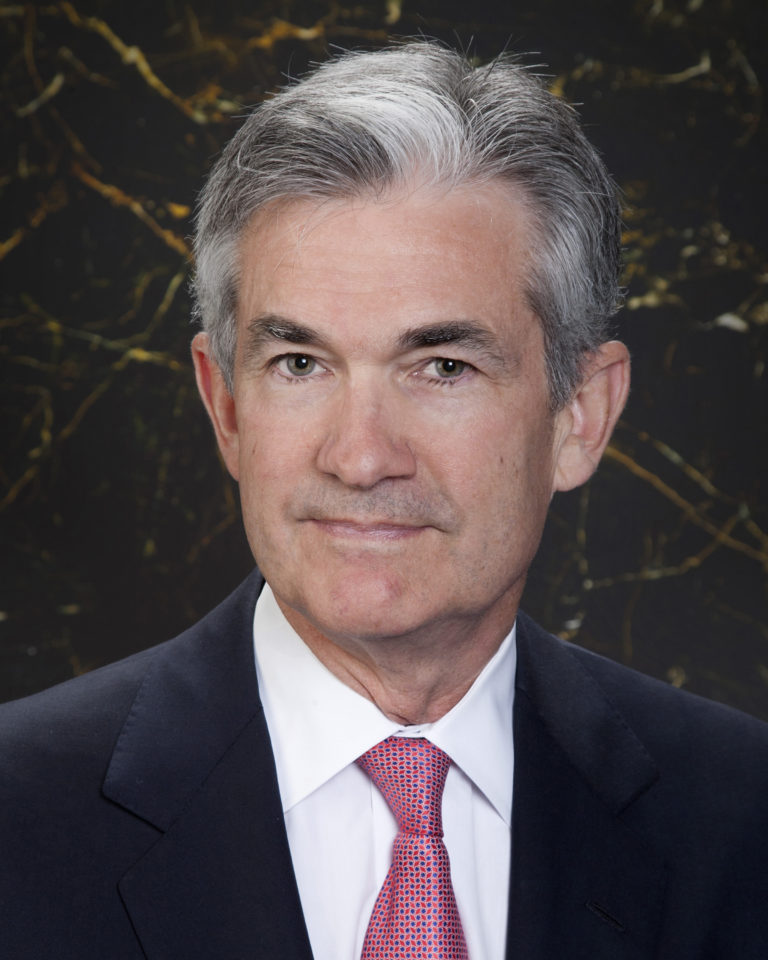

In today's rapidly evolving financial landscape, Jerome Powell stands as one of the most influential figures shaping the global economy. As the Chairman of the Federal Reserve, his decisions have profound implications for the United States and beyond. Understanding Jerome Powell's role, policies, and leadership style is crucial for anyone interested in economics, finance, and public policy.

As the world grapples with inflation, interest rates, and economic stability, Powell's tenure at the Federal Reserve has been marked by both challenges and successes. His approach to monetary policy has often been scrutinized, but his commitment to fostering economic growth while maintaining price stability remains unwavering.

This comprehensive article delves into the life, career, and contributions of Jerome Powell, providing insights into his leadership at the Federal Reserve. Whether you're a student, professional, or simply curious about the inner workings of central banking, this article offers valuable information to deepen your understanding.

Read also:Queen Latifah Kids A Comprehensive Look Into Her Family And Life

Table of Contents

- Biography of Jerome Powell

- Early Life and Education

- Career Path Before the Fed

- Jerome Powell's Chairmanship at the Federal Reserve

- Monetary Policy Under Jerome Powell

- Economic Impact of Powell's Leadership

- Challenges Faced During Powell's Tenure

- Legacy of Jerome Powell

- Criticisms and Controversies

- The Future of Monetary Policy

Biography of Jerome Powell

Jerome Powell, the current Chairman of the Federal Reserve, has carved out a distinguished career in both public service and private enterprise. Below is an overview of his life, with key details summarized in a table:

Early Life and Education

Born on February 4, 1953, in Washington, D.C., Jerome Powell grew up in a family deeply rooted in public service. His father, Jerome H. Powell, served as an Assistant Secretary of Labor during the Eisenhower administration. This background instilled in him a strong sense of duty and commitment to public service.

Powell's academic journey began at the prestigious George Washington University, where he earned a bachelor's degree in politics. He later attended Georgetown University Law Center, obtaining his Juris Doctor (J.D.) in 1979. His legal education laid the foundation for his future roles in both law and finance.

| Full Name | Jerome Howard Powell |

|---|---|

| Date of Birth | February 4, 1953 |

| Place of Birth | Washington, D.C. |

| Education | George Washington University (B.A.), Georgetown University Law Center (J.D.) |

| Family | Married to Susan Emery Powell; two children |

Career Path Before the Fed

Before assuming his role at the Federal Reserve, Jerome Powell had an illustrious career in both the private and public sectors. After completing his law degree, he worked as an associate at the law firm Davis Polk & Wardwell in New York City. His legal expertise and business acumen soon led him to the world of finance.

In 1997, Powell joined the private equity firm The Carlyle Group, where he served as a partner. His tenure at Carlyle provided him with invaluable experience in investment management and corporate finance. This background would later prove instrumental in his role at the Federal Reserve.

Key Roles Before the Fed

- Partner at The Carlyle Group (1997-2005)

- Under Secretary of the Treasury for Domestic Finance (1990-1993)

- Senior Fellow at the Bipartisan Policy Center (2012)

Jerome Powell's Chairmanship at the Federal Reserve

Jerome Powell was appointed as Chairman of the Federal Reserve in 2018 by President Donald Trump, succeeding Janet Yellen. His nomination was confirmed by the Senate with a bipartisan vote, reflecting his broad appeal across political lines. As Chairman, Powell oversees the nation's central banking system, influencing monetary policy, financial regulation, and economic stability.

Read also:Who Is Camila Araujo Ed Discovering Her Journey Achievements And Influence

Leadership Style

Powell is known for his pragmatic and data-driven approach to decision-making. He prioritizes clear communication, ensuring that the public and markets understand the Fed's policies and intentions. This transparency has helped stabilize financial markets during periods of uncertainty.

Monetary Policy Under Jerome Powell

Under Jerome Powell's leadership, the Federal Reserve has implemented several significant monetary policy measures. These policies aim to achieve the Fed's dual mandate of promoting maximum employment and maintaining price stability.

Key Policy Initiatives

- Lowering interest rates during the 2020 economic downturn

- Implementing quantitative easing to stimulate the economy

- Introducing average inflation targeting (AIT) in 2020

According to a report by the Congressional Research Service, Powell's policies have contributed to a strong labor market recovery, with unemployment rates dropping significantly since the pandemic.

Economic Impact of Powell's Leadership

The economic impact of Jerome Powell's leadership extends beyond the United States, influencing global financial markets. His decisions on interest rates and monetary policy have ripple effects on international trade, investment flows, and currency exchange rates.

Data from the Bureau of Labor Statistics indicates that under Powell's tenure, the U.S. economy has experienced sustained growth, with GDP increasing steadily despite occasional challenges. However, inflation remains a concern, prompting ongoing adjustments to monetary policy.

Challenges Faced During Powell's Tenure

Powell's tenure at the Federal Reserve has not been without challenges. The global pandemic, rising inflation, and geopolitical tensions have tested his leadership and decision-making abilities. Critics have questioned his approach to inflation targeting and interest rate adjustments, but supporters argue that his policies have been effective in stabilizing the economy.

Key Challenges

- Navigating the economic fallout of the COVID-19 pandemic

- Addressing rising inflation rates

- Managing geopolitical risks and their impact on the economy

Legacy of Jerome Powell

As his term progresses, Jerome Powell's legacy will likely be defined by his ability to navigate complex economic challenges while maintaining the Fed's independence. His commitment to transparency and accountability has earned him respect from both policymakers and the public.

According to a report by the Brookings Institution, Powell's leadership has strengthened the Fed's role as a stabilizing force in the global economy. His emphasis on data-driven decision-making and clear communication has set a benchmark for future central bankers.

Criticisms and Controversies

Despite his accomplishments, Powell has faced criticism from various quarters. Some economists argue that his inflation targeting policy may lead to overheating the economy, while others believe he has been too accommodating to Wall Street interests.

A report by the Federal Reserve Bank of St. Louis highlights the need for continued vigilance in monitoring inflationary pressures. Powell's response to these criticisms has been measured, emphasizing the importance of balancing competing priorities.

The Future of Monetary Policy

Looking ahead, the future of monetary policy under Jerome Powell will likely focus on addressing long-term challenges such as climate change, income inequality, and technological disruption. His commitment to innovation and adaptability ensures that the Federal Reserve remains a leader in shaping the global economic landscape.

Emerging Trends

- Increased focus on climate-related financial risks

- Integration of digital currencies into the financial system

- Enhanced regulatory frameworks to address systemic risks

Conclusion

In conclusion, Jerome Powell's tenure as Chairman of the Federal Reserve has been marked by significant achievements and challenges. His leadership has played a crucial role in stabilizing the U.S. economy during turbulent times. By prioritizing transparency, accountability, and data-driven decision-making, Powell has set a high standard for future central bankers.

We invite you to share your thoughts on Jerome Powell's leadership and the future of monetary policy. Leave a comment below or explore other articles on our site for more insights into economics and finance. Together, we can deepen our understanding of the forces shaping the global economy.