Today's Federal Open Market Committee (FOMC) meeting is a crucial event for investors, economists, and policymakers around the world. The decisions made during this meeting can significantly influence global financial markets, interest rates, and economic growth. As one of the most important tools in the Federal Reserve's monetary policy arsenal, the FOMC meeting attracts immense attention from market participants. In this article, we will delve into the significance of the FOMC meeting today, its impact on various sectors, and what investors should expect.

The Federal Reserve's FOMC plays a pivotal role in determining the direction of the U.S. economy by setting monetary policy. This includes decisions on interest rates, inflation targets, and other measures to ensure economic stability. Understanding the nuances of the FOMC meeting today is essential for anyone looking to make informed financial decisions.

This article aims to provide a comprehensive overview of the FOMC meeting, covering its objectives, processes, and implications. Whether you're an investor, business owner, or simply someone interested in how central banks shape the global economy, this guide will equip you with the knowledge you need to navigate the complexities of today's financial landscape.

Read also:Understanding The Catriona Gray Sam Milby Split A Comprehensive Look

What is the FOMC Meeting?

The Federal Open Market Committee (FOMC) meeting is a gathering of key policymakers from the Federal Reserve System. During these meetings, members analyze economic data, discuss monetary policy, and make decisions that affect interest rates and the overall health of the U.S. economy. The FOMC plays a central role in managing inflation, employment levels, and long-term interest rates.

Key Responsibilities of the FOMC

- Setting monetary policy to promote maximum employment and stable prices.

- Conducting open market operations to influence the federal funds rate.

- Monitoring economic indicators and adjusting policies as needed.

Today's FOMC meeting will focus on evaluating recent economic trends and determining whether adjustments to monetary policy are necessary. By analyzing data such as inflation rates, employment figures, and consumer spending, the committee aims to ensure a balanced and sustainable economic environment.

Why is the FOMC Meeting Today Important?

The FOMC meeting today is significant because it provides insights into the Federal Reserve's stance on current economic conditions. Investors closely monitor these meetings for signals about future interest rate changes, which can have far-reaching effects on financial markets. Whether the Fed decides to raise, lower, or maintain interest rates, the outcome can influence borrowing costs, investment strategies, and currency values.

Impact on Financial Markets

- Interest rate decisions directly affect bond yields and stock prices.

- Changes in monetary policy can lead to shifts in currency exchange rates.

- Investor sentiment is heavily influenced by the Fed's outlook on the economy.

For example, if the FOMC signals a potential rate hike, investors may anticipate higher borrowing costs and adjust their portfolios accordingly. Conversely, a decision to keep rates unchanged or lower them could stimulate economic growth by making borrowing more affordable.

How Does the FOMC Meeting Affect You?

Whether you're a homeowner, small business owner, or everyday consumer, the FOMC meeting today can impact your financial life. Interest rate decisions influence everything from mortgage rates to credit card APRs, affecting how much you pay for loans and how much you earn on savings accounts.

Examples of Real-World Impacts

- Homeowners may see changes in adjustable-rate mortgage payments.

- Businesses may find it easier or harder to secure loans for expansion.

- Consumers may benefit from higher returns on savings accounts.

Understanding the implications of the FOMC meeting can help individuals and businesses make better financial decisions. By staying informed, you can take advantage of opportunities and prepare for potential challenges.

Read also:Caitlin Clarks Impact And Journey In European Basketball

What Happens During an FOMC Meeting?

During the FOMC meeting today, committee members review economic data, discuss policy options, and vote on monetary policy decisions. The process involves analyzing reports on inflation, employment, GDP growth, and other key indicators. Based on this information, members decide whether to adjust the federal funds rate or implement other measures to support economic stability.

Key Steps in the Meeting Process

- Economic data review: Members assess recent trends and forecasts.

- Policy discussion: Committee members debate the appropriate course of action.

- Voting: Members cast their votes on proposed monetary policy decisions.

After the meeting concludes, the FOMC releases a statement summarizing its decisions and providing guidance on future policy directions. This statement is closely analyzed by economists and investors for clues about the Fed's outlook on the economy.

Historical Context of FOMC Meetings

Since its establishment in 1979, the FOMC has played a critical role in shaping U.S. monetary policy. Over the years, the committee has navigated numerous economic challenges, including recessions, financial crises, and periods of rapid growth. Each FOMC meeting builds on this legacy, drawing lessons from past experiences to inform current decisions.

Notable FOMC Decisions

- 1987: The Fed intervened to stabilize markets during the Black Monday stock market crash.

- 2008: The FOMC implemented emergency rate cuts during the global financial crisis.

- 2020: In response to the pandemic, the committee slashed rates to near zero.

By examining historical precedents, we can better understand the significance of today's FOMC meeting and its potential implications for the future.

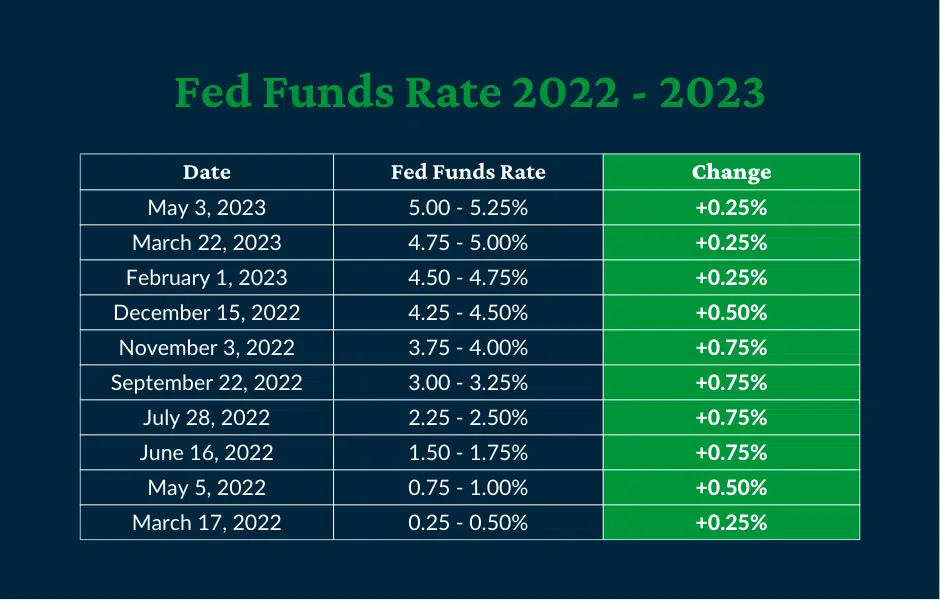

Understanding the Federal Funds Rate

The federal funds rate is a key tool used by the FOMC to influence economic activity. It represents the interest rate at which banks lend reserve balances to each other overnight. Adjustments to this rate can stimulate or slow down economic growth, depending on the Fed's objectives.

How the Federal Funds Rate Works

- Lower rates encourage borrowing and investment, boosting economic activity.

- Higher rates discourage excessive borrowing, helping to control inflation.

- The federal funds rate affects other interest rates, such as those for mortgages and car loans.

During the FOMC meeting today, committee members will carefully consider whether to adjust the federal funds rate based on current economic conditions. Their decision will have ripple effects throughout the financial system.

Impact on Global Markets

The FOMC meeting today is not only significant for the U.S. economy but also for global markets. As the world's largest economy, the United States' monetary policy decisions can influence international trade, currency values, and investment flows. Investors around the globe closely follow the FOMC's announcements for insights into the direction of global economic trends.

Key Global Impacts

- Changes in U.S. interest rates affect capital flows to emerging markets.

- A stronger dollar can impact commodity prices and trade balances.

- Monetary policy decisions influence investor confidence worldwide.

For example, a decision by the FOMC to raise interest rates could lead to capital inflows into the U.S., strengthening the dollar and potentially affecting export competitiveness for other countries. Conversely, a rate cut could stimulate global demand by making U.S. goods and services more affordable.

Preparing for the FOMC Meeting Today

As the FOMC meeting today approaches, investors and businesses can take steps to prepare for potential outcomes. By staying informed and analyzing economic data, you can make more strategic decisions about your financial future.

Tips for Investors

- Monitor economic indicators leading up to the meeting.

- Review your portfolio for potential adjustments based on expected outcomes.

- Stay updated on the FOMC's statement and press conference for immediate insights.

For businesses, understanding the implications of FOMC decisions can help with planning for future operations. Whether it's adjusting borrowing strategies or revising expansion plans, staying informed can provide a competitive edge.

Conclusion

The FOMC meeting today is a pivotal event that can shape the trajectory of the U.S. and global economies. By understanding the committee's objectives, processes, and decisions, individuals and businesses can make more informed financial choices. Whether you're an investor, policymaker, or everyday consumer, staying informed about the FOMC's actions is essential for navigating the complexities of today's financial landscape.

We encourage you to share your thoughts and insights in the comments below. How do you think the FOMC meeting today will impact your financial plans? For more in-depth analysis and updates, explore our other articles on monetary policy and economic trends. Together, let's build a more informed and prosperous future.

Table of Contents

- What is the FOMC Meeting?

- Why is the FOMC Meeting Today Important?

- How Does the FOMC Meeting Affect You?

- What Happens During an FOMC Meeting?

- Historical Context of FOMC Meetings

- Understanding the Federal Funds Rate

- Impact on Global Markets

- Preparing for the FOMC Meeting Today

- Conclusion