Fed interest rates are one of the most important economic indicators that influence both the national and global economy. Whether you're an investor, a business owner, or an average consumer, understanding how these rates work can help you make better financial decisions.

The Federal Reserve, commonly referred to as the "Fed," plays a pivotal role in shaping the U.S. economy through its monetary policies. One of its primary tools is adjusting the federal funds rate, which directly impacts borrowing costs, inflation, and overall economic growth. By understanding fed interest rates, you can anticipate changes in the market and adapt accordingly.

In this comprehensive guide, we will delve deep into the workings of fed interest rates, their effects on various sectors, and how they influence your financial life. Whether you're looking to invest, save, or simply stay informed about economic trends, this article will provide valuable insights.

Read also:Son Leo Biography The Rising Star In The Entertainment Industry

Table of Contents

- What Are Fed Interest Rates?

- How Fed Interest Rates Are Determined

- Effects on the Economy

- Impact on Consumers

- Historical Perspective

- Factors Affecting Interest Rates

- Future Predictions

- Tools Used by the Fed

- FAQ About Fed Interest Rates

- Conclusion

What Are Fed Interest Rates?

Fed interest rates, also known as federal funds rates, refer to the interest rates at which banks lend reserve balances to other banks on an overnight basis. This rate is set by the Federal Open Market Committee (FOMC), a branch of the Federal Reserve System. It serves as a benchmark for other interest rates in the economy, including those for loans, mortgages, and savings accounts.

The primary purpose of adjusting fed interest rates is to control inflation and stabilize the economy. When the economy is overheating, the Fed may raise interest rates to cool down spending and borrowing. Conversely, during economic downturns, the Fed may lower rates to encourage borrowing and stimulate growth.

Understanding fed interest rates is crucial because they affect not only the U.S. economy but also global financial markets. Changes in these rates can ripple through stock markets, currency exchanges, and international trade.

How Fed Interest Rates Are Determined

Factors Considered by the FOMC

The Federal Open Market Committee (FOMC) meets eight times a year to evaluate economic conditions and set monetary policy, including fed interest rates. Several key factors influence their decision-making process:

- Inflation Levels: The Fed aims to maintain an inflation rate of around 2%. If inflation rises too high, the FOMC may increase interest rates to curb spending.

- Employment Data: Strong employment numbers indicate a healthy economy, which may prompt the Fed to raise rates.

- GDP Growth: Gross Domestic Product (GDP) growth is another critical factor. If the economy is growing too quickly, the Fed may intervene by raising rates.

By carefully analyzing these indicators, the FOMC determines the appropriate level for fed interest rates to ensure economic stability.

Effects on the Economy

Impact on Businesses

Fed interest rates have a profound impact on businesses of all sizes. When rates are low, companies can borrow money more cheaply, enabling them to invest in expansion, research, and development. Conversely, higher rates increase borrowing costs, which can lead to reduced spending and slower growth.

Read also:Malakai Bayoh Net Worth A Comprehensive Look At The Rising Stars Fortune

For instance, during periods of low interest rates, many businesses take advantage of affordable loans to finance new projects or acquisitions. However, if rates rise significantly, businesses may delay investments, leading to slower economic growth.

Impact on Consumers

Savings Accounts and Loans

Consumers are directly affected by fed interest rates through their savings accounts, loans, and credit cards. When rates are low, borrowing becomes cheaper, making it easier for individuals to purchase homes, cars, or start businesses. On the other hand, low rates also mean lower returns on savings accounts.

Conversely, when the Fed raises interest rates, the cost of borrowing increases. This can lead to higher mortgage payments, car loans, and credit card interest rates. While savers may benefit from higher returns on their deposits, the overall cost of living can increase due to higher borrowing costs.

Historical Perspective

Key Moments in Fed Interest Rate History

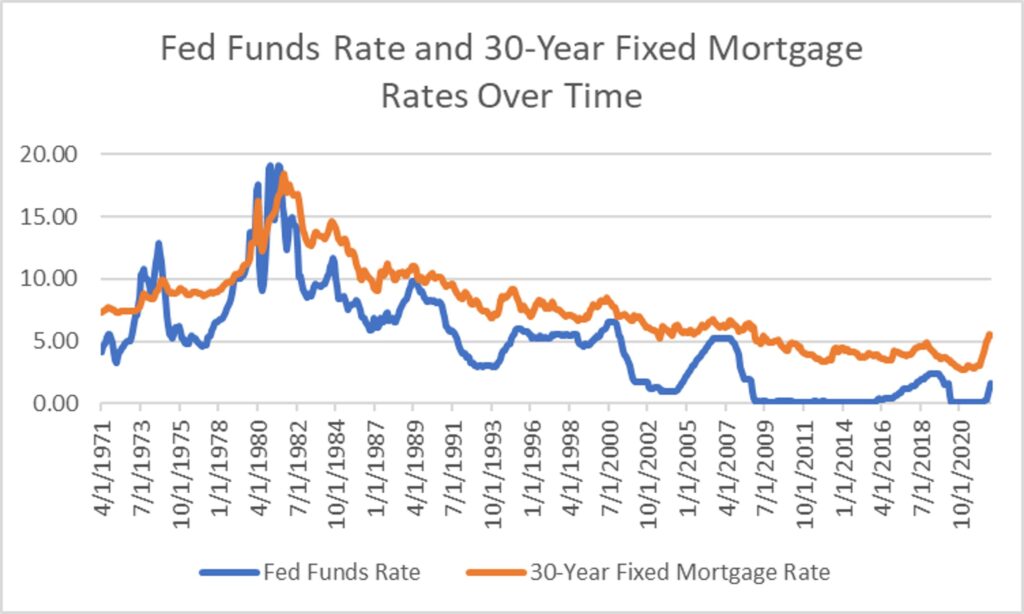

Throughout history, fed interest rates have played a critical role in shaping economic cycles. For example, during the 1980s, the Fed raised rates to combat high inflation, leading to a recession. Conversely, during the 2008 financial crisis, the Fed lowered rates to near-zero to stimulate the economy.

Understanding these historical trends can provide valuable insights into how the Fed may respond to future economic challenges. By studying past decisions, economists and policymakers can better anticipate the impact of interest rate changes on the economy.

Factors Affecting Interest Rates

Global Economic Conditions

While domestic factors like inflation and employment play a significant role in determining fed interest rates, global economic conditions also have an impact. For instance, geopolitical tensions, trade policies, and international financial crises can influence the Fed's decision-making process.

Additionally, the strength of the U.S. dollar relative to other currencies can affect interest rates. A stronger dollar may lead to lower inflation, allowing the Fed to keep rates lower for longer. Conversely, a weaker dollar may prompt the Fed to raise rates to stabilize the currency.

Future Predictions

What Lies Ahead for Fed Interest Rates?

Looking ahead, economists and analysts predict that fed interest rates will remain volatile due to ongoing economic uncertainties. Factors such as inflation, employment, and global economic conditions will continue to play a significant role in shaping future rate decisions.

As the U.S. economy continues to recover from the impacts of the pandemic, the Fed may gradually increase interest rates to prevent overheating. However, any significant changes will depend on how quickly the economy recovers and whether inflation remains under control.

Tools Used by the Fed

Beyond Interest Rates

In addition to adjusting fed interest rates, the Federal Reserve employs several other tools to manage the economy. These include:

- Open Market Operations: Buying and selling government securities to influence the money supply.

- Reserve Requirements: Setting the amount of funds banks must hold in reserve.

- Forward Guidance: Communicating future monetary policy intentions to influence market expectations.

By using these tools in conjunction with interest rate adjustments, the Fed can more effectively manage economic conditions and promote stability.

FAQ About Fed Interest Rates

Common Questions Answered

Here are some frequently asked questions about fed interest rates:

- What happens when the Fed raises interest rates? When the Fed raises interest rates, borrowing costs increase, which can slow down economic growth and reduce inflation.

- How do fed interest rates affect the stock market? Higher interest rates can lead to lower stock prices as borrowing becomes more expensive for companies and consumers.

- Can the Fed lower interest rates below zero? While theoretically possible, the Fed has not implemented negative interest rates in the U.S., as it could lead to unintended consequences.

Conclusion

In conclusion, fed interest rates are a crucial component of the U.S. economy, influencing everything from inflation to consumer spending. By understanding how these rates are determined and their effects on various sectors, you can make more informed financial decisions.

We encourage you to share this article with others who may benefit from understanding fed interest rates. Additionally, feel free to leave a comment or question below. For more insights into economic trends and personal finance, explore our other articles on the site.

Sources:

- Federal Reserve Bank of St. Louis

- U.S. Bureau of Labor Statistics

- International Monetary Fund