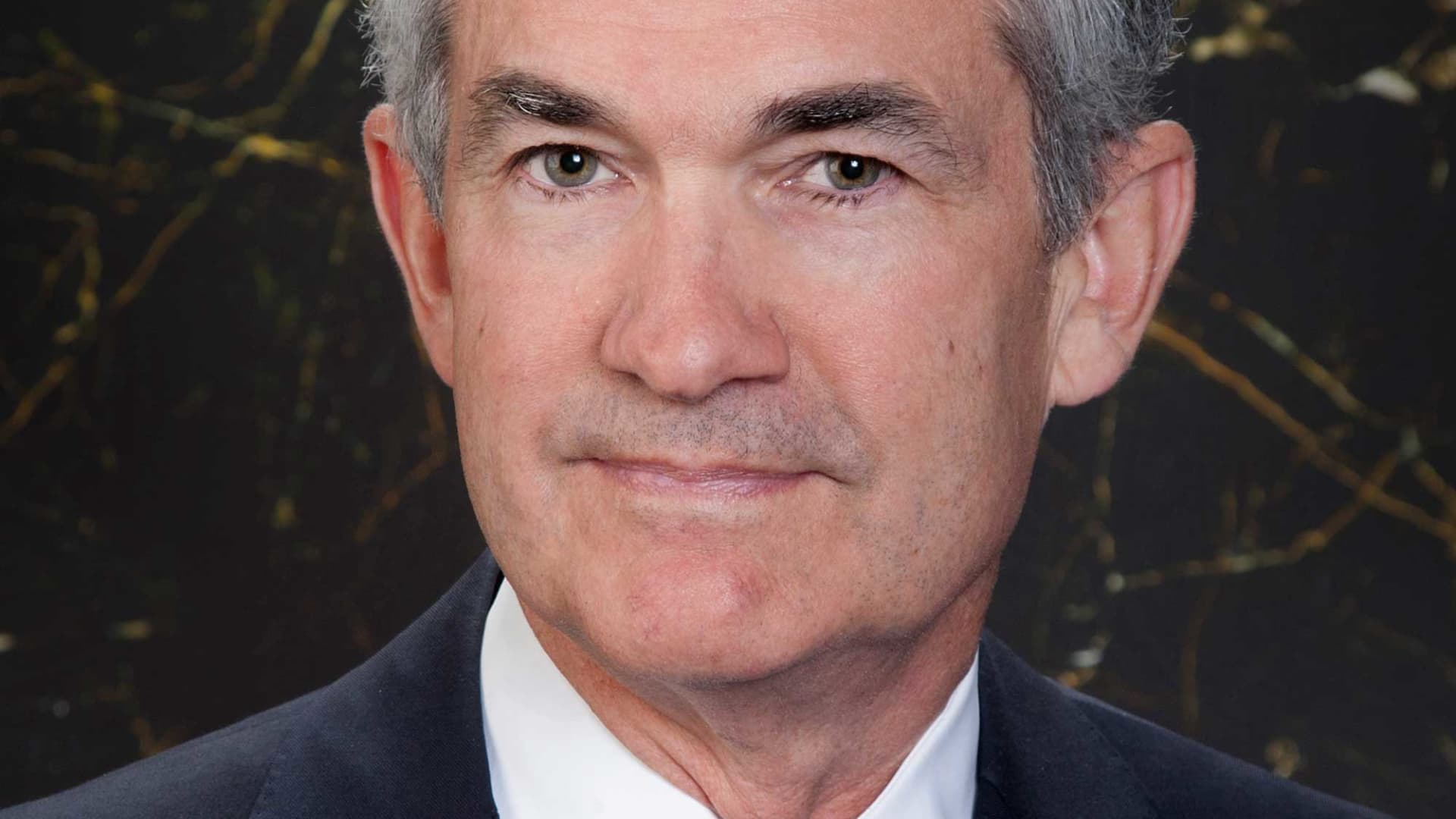

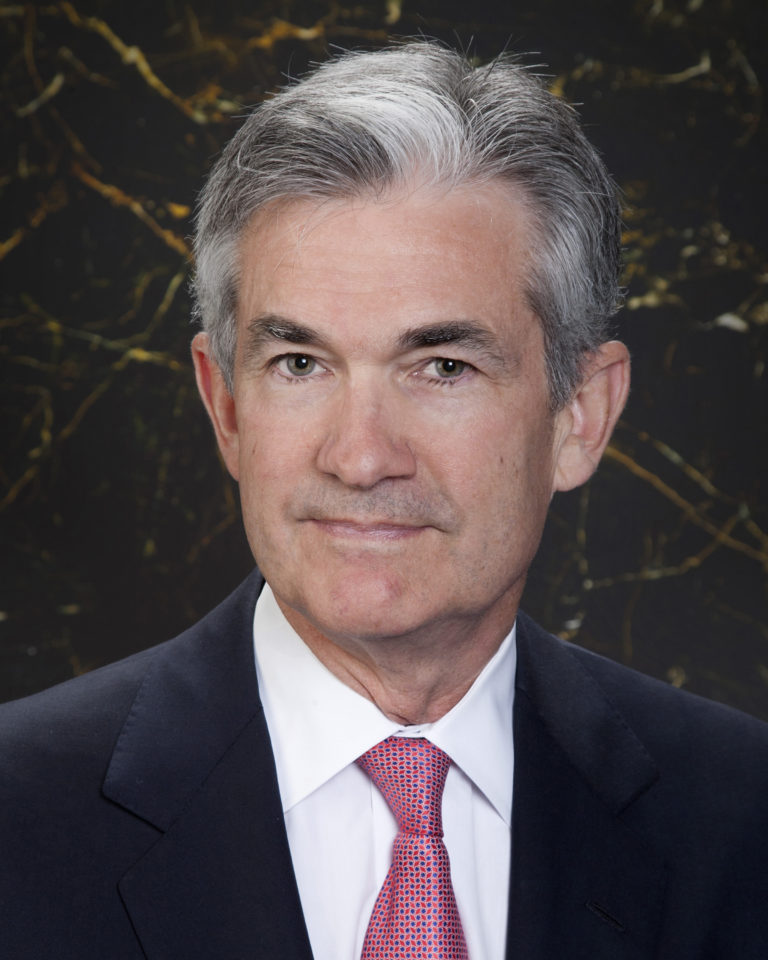

Jerome Powell, the current Chair of the Federal Reserve, has played a pivotal role in shaping the United States' monetary policy over the past few years. His decisions have far-reaching impacts on the global economy, influencing financial markets worldwide. Understanding Jerome Powell’s background, policies, and leadership style is essential for anyone interested in economics, finance, or investing.

Beyond his professional responsibilities, Powell's leadership during periods of economic uncertainty has earned him widespread recognition. From navigating the challenges of the pandemic to addressing inflation concerns, his tenure has been marked by significant milestones that continue to shape the financial landscape.

This article delves into Jerome Powell's biography, his contributions to the Federal Reserve, and the key policies he has implemented. Whether you're a student of economics, an investor, or simply curious about how central banks influence global markets, this guide offers valuable insights into one of the most influential figures in modern finance.

Read also:Iot Remote Access Behind Firewall A Comprehensive Guide

Table of Contents

- Biography of Jerome Powell

- Early Life and Education

- Career Before the Federal Reserve

- As Federal Reserve Chair

- Key Policies Under Jerome Powell

- Inflation Control Strategies

- Pandemic Response and Economic Recovery

- Global Impact of Powell's Leadership

- Challenges Faced by Jerome Powell

- Future Outlook and Predictions

- Conclusion

Biography of Jerome Powell

Jerome H. Powell, born on February 4, 1953, in Washington, D.C., is a prominent figure in the world of finance and economics. As the Chair of the Federal Reserve since February 2018, Powell has been at the helm during some of the most challenging economic periods in recent history. His leadership style and decision-making have been closely watched by policymakers, investors, and economists worldwide.

Early Life and Education

Powell's journey to becoming the Federal Reserve Chair began with a strong educational foundation. He attended George Washington University, where he earned a Bachelor of Arts in Politics. Later, he pursued a law degree from Georgetown University Law Center, graduating in 1979. This diverse academic background equipped him with the skills necessary to navigate the complexities of financial regulation and policymaking.

Before entering public service, Powell worked as a lawyer and later transitioned to the financial sector, gaining valuable experience that would later inform his approach to monetary policy.

Career Before the Federal Reserve

Prior to his appointment as Federal Reserve Chair, Powell held several significant roles. He served as an Under Secretary of the Treasury for Financial Institutions under President George H.W. Bush, where he focused on regulatory reforms. After leaving government service, Powell joined the private sector, working as a partner at The Carlyle Group, a prominent private equity firm.

In 2012, Powell returned to public service when he was appointed as a Governor of the Federal Reserve Board. This role provided him with hands-on experience in monetary policy, setting the stage for his eventual appointment as Chair.

As Federal Reserve Chair

As the Chair of the Federal Reserve, Jerome Powell oversees one of the most influential central banks in the world. His responsibilities include setting monetary policy, ensuring financial stability, and promoting maximum employment and stable prices. Powell's tenure has been marked by a commitment to transparency and accountability, qualities that have earned him respect across political and economic lines.

Read also:What Is Secure Shell In Iot And How It Works

Key Policies Under Jerome Powell

Under Powell's leadership, the Federal Reserve has implemented several key policies aimed at stabilizing the economy and fostering growth. These include:

- Interest Rate Adjustments: Powell has skillfully navigated interest rate adjustments to address inflation and economic growth concerns.

- Quantitative Easing: During periods of economic uncertainty, the Federal Reserve has employed quantitative easing to inject liquidity into the market.

- Forward Guidance: Powell has emphasized clear communication about future monetary policy actions to provide certainty to markets.

These policies have been instrumental in maintaining economic stability during challenging times.

Inflation Control Strategies

One of the most pressing issues during Powell's tenure has been managing inflation. The Federal Reserve has adopted a dual mandate approach, focusing on both employment and price stability. Powell's strategies for controlling inflation include:

- Monitoring economic indicators closely to anticipate inflationary pressures.

- Adjusting interest rates to balance economic growth with inflation control.

- Implementing targeted measures to address supply chain disruptions.

These efforts have been crucial in maintaining consumer confidence and preventing runaway inflation.

Pandemic Response and Economic Recovery

When the global pandemic struck in 2020, Jerome Powell and the Federal Reserve acted swiftly to mitigate its economic impact. Measures taken included:

- Lowering interest rates to near-zero levels to stimulate borrowing and spending.

- Launching emergency lending facilities to support businesses and households.

- Collaborating with government agencies to implement fiscal stimulus packages.

These actions were instrumental in stabilizing the economy and facilitating a robust recovery.

Global Impact of Powell's Leadership

Powell's decisions as Federal Reserve Chair have had a profound impact on the global economy. Central banks worldwide often look to the Federal Reserve for guidance on monetary policy, making Powell's leadership particularly influential. His commitment to transparency and international cooperation has strengthened global financial stability.

Challenges Faced by Jerome Powell

Despite his successes, Powell has faced numerous challenges during his tenure. These include:

- Addressing rising inflation without stifling economic growth.

- Navigating political pressures and maintaining independence.

- Managing the transition to a post-pandemic economic environment.

Powell's ability to navigate these challenges has demonstrated his expertise and resilience as a leader.

Future Outlook and Predictions

Looking ahead, Jerome Powell's leadership will continue to shape the economic landscape. Key areas of focus are likely to include:

- Sustaining economic growth while controlling inflation.

- Addressing climate change and its economic implications.

- Enhancing financial inclusion and reducing inequality.

As the global economy evolves, Powell's vision and leadership will remain critical in guiding the Federal Reserve's policies.

Conclusion

Jerome Powell's tenure as Federal Reserve Chair has been marked by decisive leadership and a commitment to economic stability. From navigating the challenges of the pandemic to addressing inflation concerns, his policies have had a lasting impact on both the U.S. and global economies.

We invite you to engage with this content by sharing your thoughts in the comments section below. For more insights into economics and finance, explore our other articles. Together, let's continue the conversation about the future of global finance and economic policy.

Data Sources: Federal Reserve, U.S. Department of the Treasury, International Monetary Fund