When it comes to global economic stability, the Federal Reserve plays a crucial role through its FOMC meetings. These gatherings have far-reaching implications for both national and international markets. The FOMC meeting is not just a routine event; it is a pivotal decision-making forum that shapes monetary policy and economic growth strategies.

The Federal Open Market Committee (FOMC) meeting is one of the most anticipated events in the financial calendar. Investors, economists, and policymakers worldwide closely monitor these meetings to gauge the direction of U.S. monetary policy. The outcomes of these sessions can influence interest rates, inflation targets, and overall economic health.

In this comprehensive guide, we will delve into the intricacies of FOMC meetings, exploring their structure, purpose, and impact on the global economy. Whether you're an investor, a student of economics, or simply curious about how central banks influence financial markets, this article will provide valuable insights into the workings of the Federal Reserve's most important committee.

Read also:Tsunami 2025 California Today Understanding The Risks And Preparedness

Table of Contents

- Introduction to FOMC Meeting

- What is the FOMC?

- Structure of the FOMC

- Purpose of FOMC Meetings

- FOMC Meeting Schedule

- Impact on the Economy

- Key Decisions Made During FOMC Meetings

- Analyzing FOMC Statements

- Historical Significance of FOMC Meetings

- Future Trends in FOMC Meetings

- Conclusion

Introduction to FOMC Meeting

The Federal Open Market Committee (FOMC) meeting is a cornerstone of U.S. monetary policy. Held eight times annually, these meetings bring together key decision-makers from the Federal Reserve to assess economic conditions and determine appropriate monetary policy actions. The primary objective of the FOMC is to promote maximum employment and stable prices, as mandated by the Federal Reserve Act.

During these sessions, committee members review economic data, analyze market trends, and discuss potential policy adjustments. The decisions made during FOMC meetings can have immediate and lasting effects on financial markets, influencing everything from mortgage rates to stock prices. Understanding the FOMC's role and processes is essential for anyone seeking to navigate the complexities of modern finance.

What is the FOMC?

The Federal Open Market Committee (FOMC) is the monetary policymaking body of the Federal Reserve System. Established in 1913, the FOMC is responsible for implementing monetary policy in the United States. Its primary tools include setting target federal funds rates, conducting open market operations, and adjusting reserve requirements.

Key Members of the FOMC

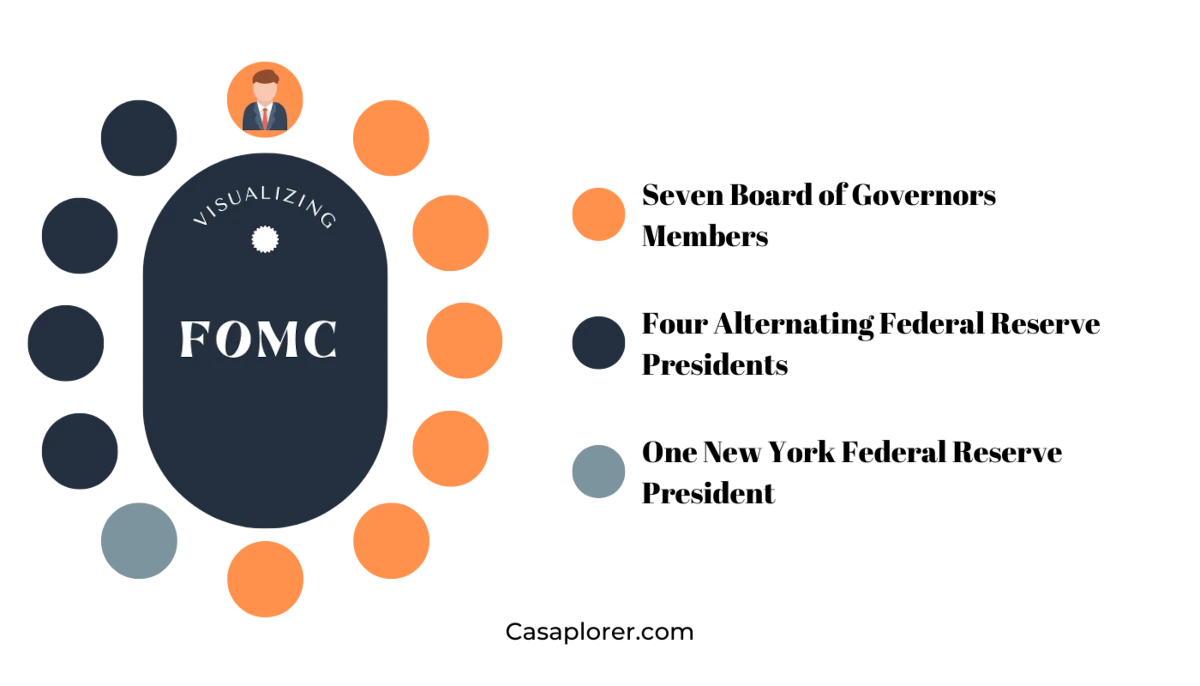

- Federal Reserve Board of Governors (7 members)

- President of the Federal Reserve Bank of New York

- Four rotating presidents from the remaining 11 Federal Reserve Banks

The FOMC operates under a voting system, with each member casting a vote on proposed policy actions. This collaborative approach ensures that diverse perspectives are considered in decision-making processes.

Structure of the FOMC

The FOMC consists of 12 members, combining the expertise of the Federal Reserve Board and regional Federal Reserve Banks. This structure ensures a balanced representation of national and regional economic interests. The Board of Governors provides a macroeconomic perspective, while regional presidents offer insights into local economic conditions.

Roles and Responsibilities

- Setting monetary policy objectives

- Conducting open market operations

- Monitoring economic indicators

- Communicating policy decisions to the public

This collaborative framework enables the FOMC to respond effectively to changing economic environments and implement policies that promote sustainable growth.

Read also:Elon Musks Foot Exploring The Curiosity Around The Tech Moguls Feet

Purpose of FOMC Meetings

The primary purpose of FOMC meetings is to evaluate economic conditions and determine appropriate monetary policy actions. By analyzing data on employment, inflation, and economic growth, the committee aims to achieve its dual mandate of maximum employment and price stability. The FOMC also considers global economic trends and financial market developments when formulating policy decisions.

Key Objectives

- Promote economic growth

- Control inflation

- Ensure financial stability

Through its actions, the FOMC seeks to create an environment conducive to long-term economic prosperity while mitigating risks to the financial system.

FOMC Meeting Schedule

FOMC meetings are scheduled eight times per year, typically lasting one to two days. These meetings follow a predetermined calendar, allowing market participants to anticipate their timing and prepare accordingly. Each session includes a review of economic data, discussions on policy options, and a vote on proposed actions.

Key Components of FOMC Meetings

- Economic data review

- Policy discussions

- Voting on policy decisions

- Post-meeting press conference

Following each meeting, the FOMC releases a statement summarizing its decisions and rationale. This statement provides valuable insights into the committee's thinking and serves as a guide for market participants.

Impact on the Economy

The decisions made during FOMC meetings have significant implications for the economy. Changes in monetary policy can influence interest rates, inflation, and economic growth. For example, raising the federal funds rate can slow economic activity by increasing borrowing costs, while lowering it can stimulate growth by making credit more accessible.

Effects on Financial Markets

- Interest rate adjustments

- Stock market performance

- Currency valuation

Investors closely monitor FOMC meetings for clues about future policy directions, as these signals can impact asset prices and investment strategies.

Key Decisions Made During FOMC Meetings

During FOMC meetings, committee members focus on several key decisions, including setting target federal funds rates, adjusting asset purchase programs, and revising forward guidance. These decisions are based on thorough analysis of economic data and projections.

Recent FOMC Decisions

- Federal funds rate adjustments

- Quantitative easing programs

- Forward guidance revisions

Each decision is carefully considered to ensure alignment with the FOMC's dual mandate and broader economic objectives.

Analyzing FOMC Statements

FOMC statements provide valuable insights into the committee's thinking and policy intentions. These statements typically include summaries of economic conditions, assessments of risks, and explanations of policy decisions. Analysts and investors scrutinize these documents for clues about future policy directions.

Key Elements of FOMC Statements

- Economic condition summaries

- Risk assessments

- Policy decision explanations

Understanding how to interpret FOMC statements can enhance one's ability to anticipate market movements and make informed investment decisions.

Historical Significance of FOMC Meetings

Throughout its history, the FOMC has played a pivotal role in shaping U.S. monetary policy. From navigating economic crises to fostering periods of sustained growth, the committee's decisions have had lasting impacts on the global economy. Key historical events, such as the Great Recession and the COVID-19 pandemic, highlight the FOMC's ability to adapt to changing circumstances and implement effective policy responses.

Notable FOMC Actions

- Quantitative easing programs during the 2008 financial crisis

- Interest rate cuts during the COVID-19 pandemic

- Long-term policy adjustments to combat inflation

These actions demonstrate the FOMC's commitment to maintaining economic stability and promoting sustainable growth.

Future Trends in FOMC Meetings

As the global economy continues to evolve, the FOMC faces new challenges and opportunities. Emerging trends, such as digital currencies, climate change, and technological advancements, will likely influence future policy decisions. The committee must remain adaptable and forward-thinking to address these developments effectively.

Potential Future Developments

- Central bank digital currencies

- Climate-related monetary policy

- Technological innovation in financial systems

By staying informed about these trends, the FOMC can continue to play a leading role in shaping the future of monetary policy.

Conclusion

The Federal Open Market Committee (FOMC) meeting is a critical component of U.S. monetary policy, influencing economic conditions and financial markets worldwide. Through its decisions, the FOMC strives to achieve maximum employment, stable prices, and long-term economic growth. Understanding the structure, purpose, and impact of FOMC meetings is essential for anyone seeking to navigate the complexities of modern finance.

We invite you to share your thoughts and insights in the comments section below. Additionally, feel free to explore other articles on our site for more in-depth coverage of economic and financial topics. Together, let's continue the conversation about the future of monetary policy and its implications for global economies.