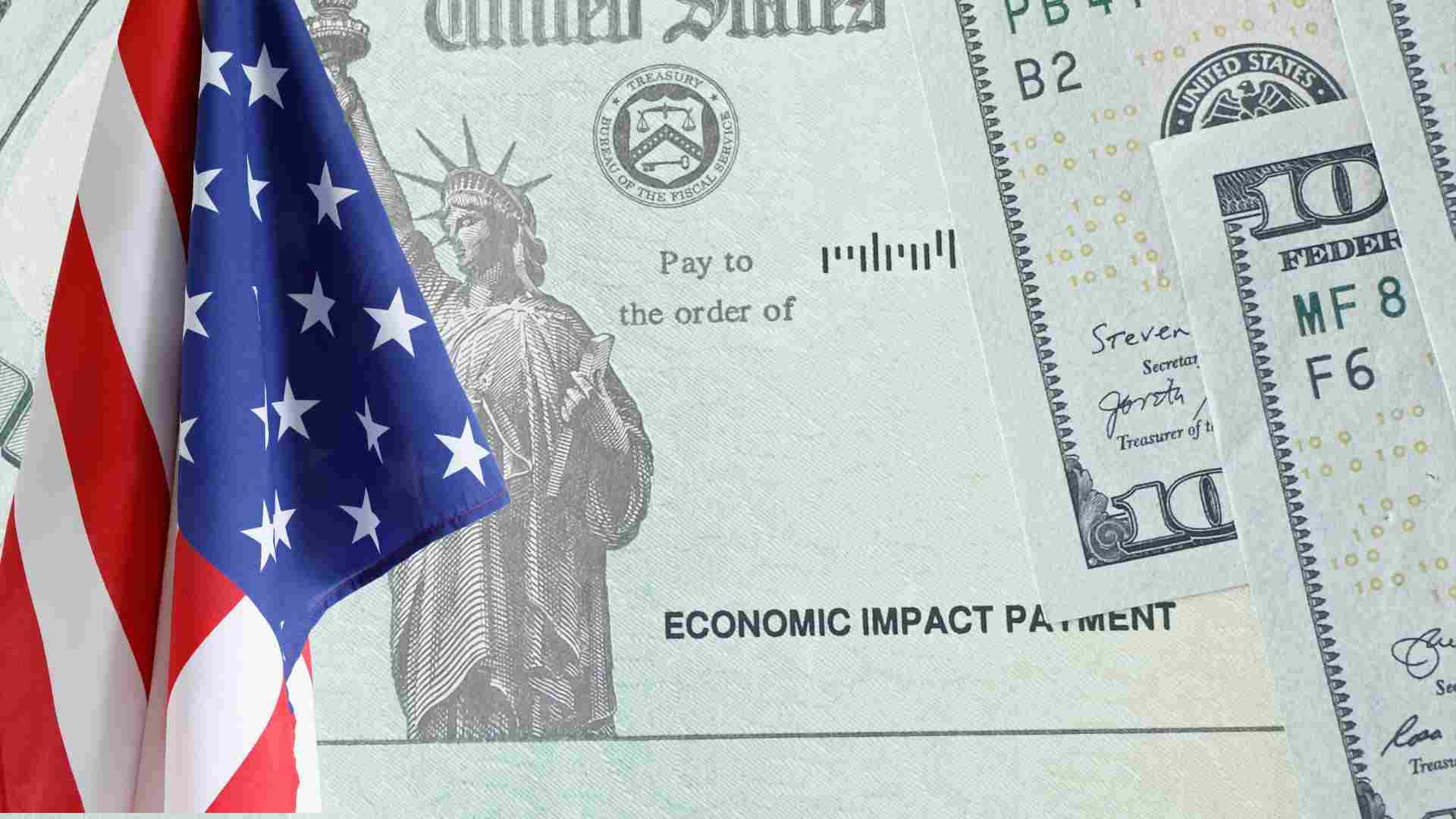

Millions of Americans are still eligible for a $1,400 stimulus check as part of the American Rescue Plan Act. If you haven’t received your payment yet, it’s crucial to understand the eligibility criteria and steps to claim your stimulus funds.

The economic impact of the ongoing global pandemic has led the U.S. government to introduce multiple stimulus packages to support individuals and families. One of the key components of these packages is the $1,400 stimulus check, designed to provide financial relief to those who need it most.

This article will guide you through the eligibility requirements, how to check if you qualify, and the steps you can take to claim your stimulus payment. Whether you’re a single filer, head of household, or married couple, we’ll break down everything you need to know about this critical financial support.

Read also:Ironmouse Age Unveiling The Life And Legacy Of A Virtual Streaming Icon

Table of Contents

- Introduction to the $1,400 Stimulus Check

- Who is Eligible for the $1,400 Stimulus Check?

- Income Limits and Adjusted Gross Income (AGI)

- Dependents and Additional Payments

- How to Check Your Stimulus Payment Status

- What to Do if You’re Missing a Stimulus Check

- Filing Tax Returns to Claim Your Stimulus

- Special Cases: Non-Filers and Low-Income Individuals

- Eligibility for U.S. Citizens Living Abroad

- Frequently Asked Questions About Stimulus Checks

Introduction to the $1,400 Stimulus Check

The $1,400 stimulus check is part of the third round of direct payments authorized under the American Rescue Plan Act of 2021. This initiative aims to provide immediate financial assistance to individuals and families affected by the economic challenges brought on by the pandemic.

Eligible recipients include those with qualifying income levels, dependents, and specific tax filing statuses. The IRS uses your most recent tax return to determine your eligibility and the amount of your payment. Understanding the program’s details can help you ensure you receive the funds you’re entitled to.

Who is Eligible for the $1,400 Stimulus Check?

Eligibility for the $1,400 stimulus check is based on your filing status and income level. Below are the primary criteria:

- Single Filers: Individuals earning up to $75,000 annually qualify for the full amount.

- Married Couples Filing Jointly: Couples earning up to $150,000 qualify for the full payment.

- Heads of Household: Those earning up to $112,500 qualify for the full payment.

As your income exceeds these thresholds, the payment amount gradually decreases until it phases out entirely.

Eligibility Criteria Variations

It’s important to note that dependents also play a role in determining eligibility. Unlike previous rounds, the third stimulus check includes payments for all dependents, regardless of age.

Income Limits and Adjusted Gross Income (AGI)

Your eligibility for the $1,400 stimulus check depends heavily on your Adjusted Gross Income (AGI). The IRS uses your most recent tax return to calculate this figure. Here’s how AGI affects your payment:

Read also:Discovering The World Of Actress S A Comprehensive Guide

- Single filers with AGIs above $80,000 are ineligible.

- Married couples filing jointly with AGIs above $160,000 are ineligible.

- Heads of household with AGIs above $120,000 are ineligible.

These income limits ensure that the payments reach those most in need while maintaining fiscal responsibility.

Dependents and Additional Payments

One of the notable changes in the third stimulus check is the inclusion of all dependents, regardless of age. This means that parents can receive an additional $1,400 per dependent child or adult dependent.

Types of Dependents Covered

Dependents eligible for the additional payment include:

- Children under 17.

- Adult dependents, such as college students or disabled individuals.

- Dependent relatives, including elderly parents.

This expansion aims to provide broader support to families with various financial responsibilities.

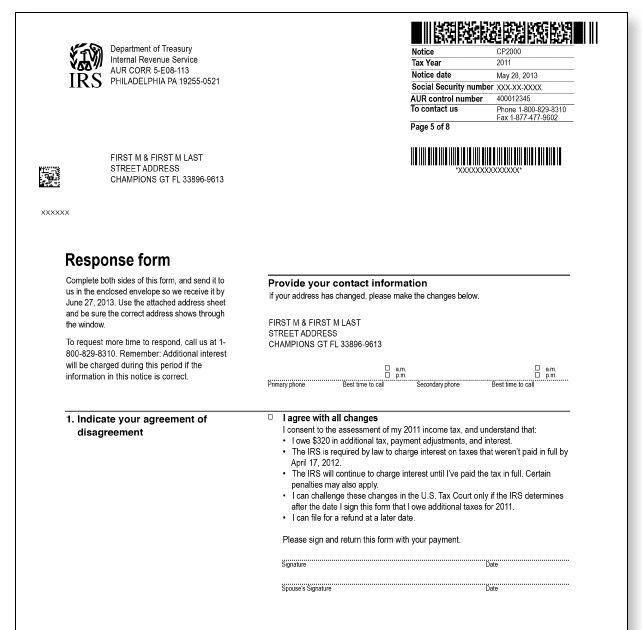

How to Check Your Stimulus Payment Status

To check the status of your $1,400 stimulus payment, you can use the IRS’s “Get My Payment” tool. This online resource allows you to track your payment and verify its delivery method.

Steps to Use the IRS Tool

Follow these steps to check your payment status:

- Visit the IRS website and navigate to the “Get My Payment” tool.

- Enter your Social Security number, date of birth, and filing status.

- Review the information provided, including the estimated payment date and method.

Keep in mind that the tool may not have updated information immediately after the IRS processes your payment.

What to Do if You’re Missing a Stimulus Check

If you believe you’re eligible for a $1,400 stimulus check but haven’t received it, there are steps you can take to claim your payment:

- Verify your eligibility using the IRS guidelines.

- Check the “Get My Payment” tool for updates on your payment status.

- Contact the IRS if you believe there’s an error in your payment information.

In some cases, you may need to file a Recovery Rebate Credit claim on your 2021 tax return to receive the missing payment.

Filing Tax Returns to Claim Your Stimulus

For those who haven’t filed their 2020 or 2021 tax returns, doing so is essential to receive your $1,400 stimulus check. The IRS uses your tax information to determine eligibility and calculate your payment amount.

Tips for Filing Your Tax Return

Here are some tips to ensure a smooth filing process:

- Gather all necessary documents, including W-2s, 1099s, and dependents’ information.

- Use IRS-approved tax software or consult a tax professional for assistance.

- Submit your return as early as possible to expedite the payment process.

Filing your tax return not only helps you claim your stimulus payment but also ensures you receive any other applicable credits or refunds.

Special Cases: Non-Filers and Low-Income Individuals

Non-filers and low-income individuals may still qualify for the $1,400 stimulus check. The IRS provides resources to help these groups claim their payments without the need for a traditional tax return.

Resources for Non-Filers

The IRS offers the following resources for non-filers:

- Non-Filer Sign-Up Tool: A simplified form for claiming stimulus payments.

- Free File Program: Access to free tax preparation software for eligible individuals.

These resources aim to ensure that all eligible Americans receive the financial support they need.

Eligibility for U.S. Citizens Living Abroad

U.S. citizens living abroad may also qualify for the $1,400 stimulus check, provided they meet the eligibility criteria. To receive the payment, they must file a U.S. tax return and include their foreign address.

Steps for U.S. Expatriates

Here’s what U.S. citizens living abroad should do to claim their stimulus payment:

- File a U.S. tax return, even if you’re not required to do so.

- Include your foreign address on your tax return.

- Check the IRS website for updates on international payment methods.

By following these steps, expatriates can ensure they receive the financial assistance they’re entitled to.

Frequently Asked Questions About Stimulus Checks

How Long Will It Take to Receive My Payment?

The IRS processes payments as quickly as possible, but delivery times vary based on the method chosen. Direct deposits typically arrive within a few days, while paper checks may take several weeks.

Can I Claim a Stimulus Check if I Owe Back Taxes?

Yes, stimulus payments are not offset by back taxes or other federal debts. However, state tax agencies may still have the authority to withhold payments for state-level debts.

What Should I Do if My Payment Information Is Incorrect?

If you believe there’s an error in your payment information, contact the IRS directly or consult a tax professional for assistance. Providing updated information as soon as possible can help resolve the issue.

Conclusion

The $1,400 stimulus check represents a significant opportunity for millions of Americans to receive much-needed financial relief. By understanding the eligibility criteria, checking your payment status, and taking the necessary steps to claim your funds, you can ensure you receive the support you deserve.

We encourage you to share this article with friends and family who may benefit from the information. Additionally, feel free to leave a comment below if you have any questions or need further clarification. Together, we can help ensure that everyone eligible for the stimulus check receives their payment.