Student loans repayment can be a daunting challenge for many graduates. As the cost of higher education continues to rise, the burden of repaying student loans has become a significant concern for millions of young professionals. Understanding the intricacies of student loan repayment options is crucial to managing your finances effectively and securing your financial future.

Graduating from college is a significant milestone, but it also marks the beginning of financial responsibility. For many, this includes managing student loans repayment. This guide aims to demystify the process and provide actionable insights to help you navigate the complexities of repaying your student loans.

Whether you're just starting your repayment journey or looking to optimize your current strategy, this article will serve as a valuable resource. We’ll cover everything from repayment plans to loan forgiveness programs, ensuring you have all the tools you need to succeed.

Read also:Alyxe Star Unveiling The Rising Star In The Entertainment Industry

Understanding Student Loans Repayment

What Are Student Loans?

Student loans are financial aids extended to students to help them cover the costs of higher education, including tuition, books, and living expenses. These loans come in various forms, such as federal loans, private loans, and institutional loans. Each type has its own repayment terms and conditions.

Federal student loans are typically more flexible and offer better repayment options compared to private loans. Understanding the differences between these types is essential for effective student loans repayment planning.

Key Factors Affecting Repayment

Several factors influence how you repay your student loans:

- Loan Type: Federal or private loans have different repayment terms.

- Interest Rates: Variable or fixed interest rates affect the total amount you repay.

- Repayment Terms: Standard, income-driven, or extended repayment plans determine your monthly payments.

- Credit Score: For private loans, your credit score can impact the interest rate and repayment options.

Being aware of these factors allows you to make informed decisions about your student loans repayment strategy.

Repayment Options for Student Loans

Standard Repayment Plan

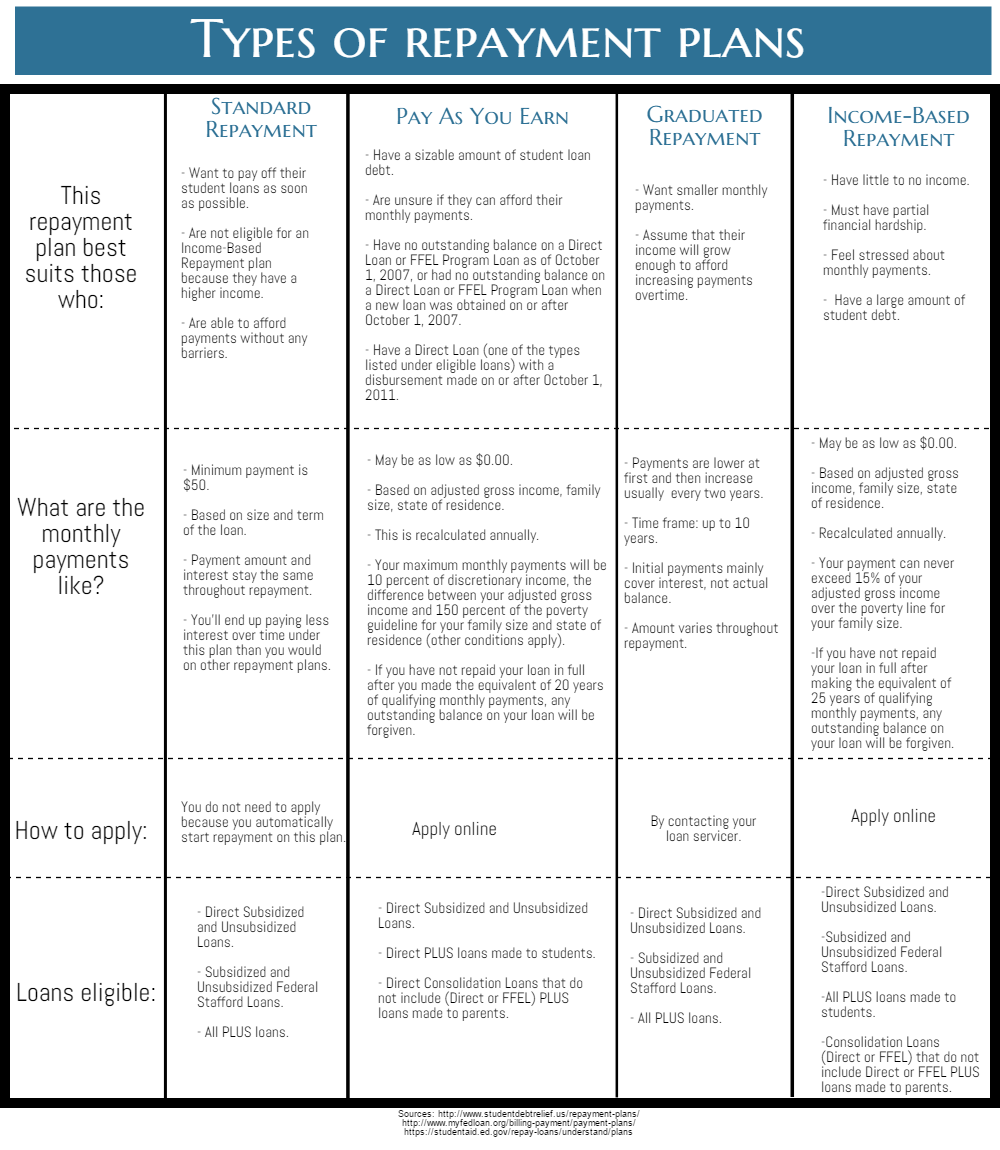

The standard repayment plan is the default option for federal student loans. It requires fixed monthly payments over a period of 10 years. While this plan results in higher monthly payments, it also means you’ll pay less in interest over the life of the loan.

This plan is ideal for borrowers who can comfortably afford higher monthly payments and want to pay off their loans quickly.

Read also:How Tall Is Jared Padalecki Unveiling The Height Of The Supernatural Star

Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payments based on your income and family size. These plans include:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

These plans are designed to make student loans repayment more manageable for borrowers with lower incomes. They extend the repayment period to 20 or 25 years, depending on the plan.

Managing Your Student Loans Repayment

Creating a Budget

Creating a budget is essential for managing your student loans repayment. Start by listing all your monthly expenses and income. Prioritize your student loan payments and allocate a specific amount each month. This ensures you stay on track with your repayments and avoid falling behind.

Automating Payments

Setting up automatic payments can help you stay organized and ensure you never miss a payment. Many lenders offer interest rate reductions for borrowers who opt for automatic payments, which can save you money in the long run.

Dealing with Financial Hardship

If you encounter financial difficulties, there are options available to help you manage your student loans repayment. You can apply for deferment or forbearance, which temporarily suspends your payments. However, interest may continue to accrue during this period.

Exploring Loan Forgiveness Programs

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness program forgives the remaining balance on your federal student loans after you’ve made 120 qualifying payments while working full-time for a qualifying employer. This program is ideal for those in public service careers, such as teachers, nurses, and government employees.

Teacher Loan Forgiveness

Teachers who work in low-income schools or educational service agencies for five consecutive years may qualify for loan forgiveness under the Teacher Loan Forgiveness program. This program can forgive up to $17,500 of eligible federal student loans.

Consolidation and Refinancing

Loan Consolidation

Loan consolidation combines multiple federal student loans into a single loan with a fixed interest rate. This simplifies the repayment process and can lower your monthly payments. However, it may extend the repayment period and increase the total amount you pay in interest.

Loan Refinancing

Loan refinancing involves replacing your existing student loans with a new loan, often with a lower interest rate. This can reduce your monthly payments and save you money over time. However, refinancing federal loans with a private lender means you lose access to federal benefits like income-driven repayment plans and loan forgiveness programs.

Strategies for Accelerating Repayment

Make Extra Payments

Making extra payments toward your student loans can significantly reduce the total amount of interest you pay and shorten the repayment period. Focus on paying down loans with higher interest rates first to maximize your savings.

Bi-Weekly Payments

Instead of making one monthly payment, consider making half of your payment every two weeks. This results in an extra payment each year, helping you pay off your loans faster.

Employer Assistance Programs

Some employers offer student loan repayment assistance as part of their benefits package. Check with your employer to see if they offer such programs and take advantage of them if available.

Common Mistakes to Avoid

Ignoring Repayment Deadlines

Missing repayment deadlines can lead to late fees, damage to your credit score, and even default. Set reminders or use automatic payments to ensure you never miss a payment.

Refinancing Without Understanding the Terms

Before refinancing your student loans, carefully review the terms and conditions. Ensure that the new interest rate is lower and that you’re not losing valuable benefits by switching to a private lender.

Not Exploring All Repayment Options

Many borrowers fail to explore all available repayment options, such as income-driven plans or loan forgiveness programs. Take the time to research and understand all the options available to you.

Resources for Student Loans Repayment

Federal Student Aid

The Federal Student Aid website offers a wealth of information on student loans repayment, including repayment calculators, eligibility requirements, and contact information for loan servicers.

Student Loan Repayment Calculators

Use online repayment calculators to estimate your monthly payments under different repayment plans. This helps you choose the plan that best suits your financial situation.

Financial Advisors

Consulting with a financial advisor can provide personalized guidance on managing your student loans repayment. They can help you develop a comprehensive financial plan that includes your student loans.

Daftar Isi

Understanding Student Loans Repayment

Key Factors Affecting Repayment

Repayment Options for Student Loans

Managing Your Student Loans Repayment

Exploring Loan Forgiveness Programs

Public Service Loan Forgiveness (PSLF)

Kesimpulan

In conclusion, mastering student loans repayment requires a combination of knowledge, planning, and discipline. By understanding the various repayment options, exploring forgiveness programs, and implementing effective strategies, you can take control of your financial future.

We encourage you to share your experiences and tips in the comments below. Additionally, consider exploring other articles on our site for more insights into personal finance and student loans repayment. Together, we can build a community of informed and financially savvy individuals.